The Future of Real Estate is Digital – Here’s How Tech Influences Buying, Selling and Renting UAE Properties

Beneath the iconic skyline of the UAE and the master-planned communities of Abu Dhabi, a quieter, more profound revolution is reshaping the very bedrock of real estate.

UAE is a market long defined by its audacious vision and relentless growth.

It is now pioneering into a new frontier, a complete age of digitization of the real estate world.

We are not merely talking about listing properties online, we are talking about a complete systemic overhaul. We are discussing AI-driven valuations, metaverse viewings, blockchain based transactions which are solving deep rooted market inefficiencies and setting a benchmark.

With over 200 nationalities investing in Dubai Real Estate, the demand for remote and transparent processes have simply become non-negotiable.

So what does the future of UAE real estate hold in this present age of digital? How tech is changing how people buy, sell and rent properties?

Let’s check out.

Table of Contents

The Rise of Proptech in UAE

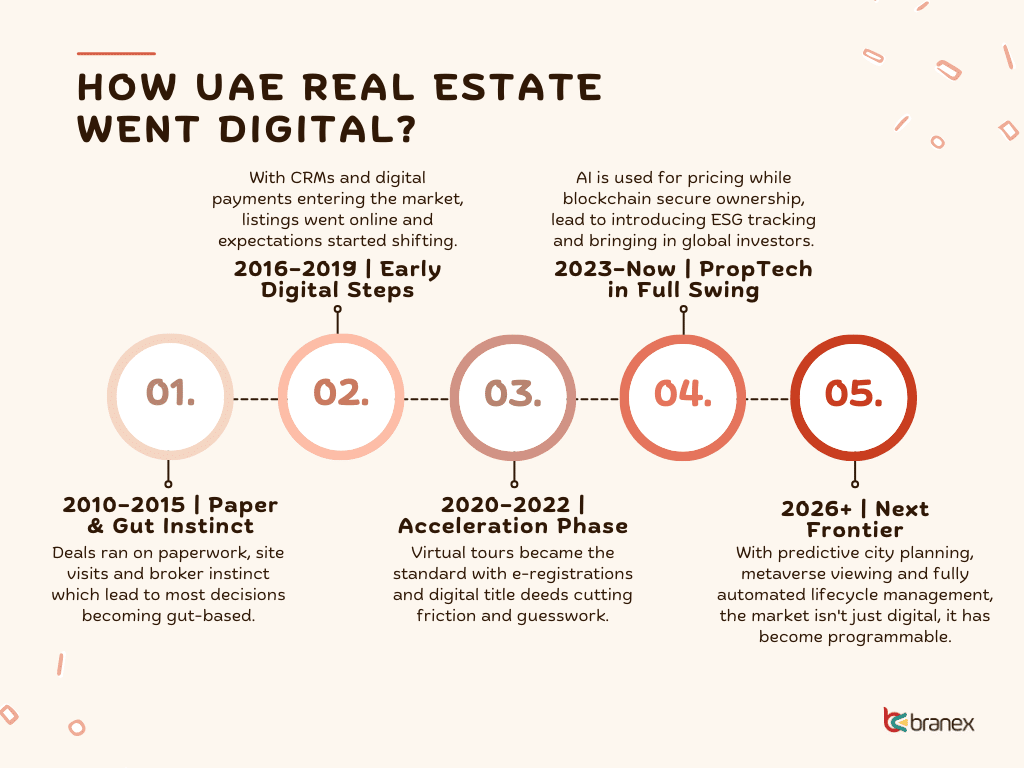

A few years ago, real estate in the UAE ran on paperwork, phone calls, and site visits.

Data existed, but it lived in silos.

Deals were closing fast, yet decisions were still gut-based. Buildings and architecture looked impressive on the outside, but behind the scenes, everything was handled manually.

Then PropTech quietly entered the chat.

It started with a shift in expectations.

Buyers wanted virtual tours instead of endless site visits.

Investors wanted numbers, not narratives.

Tenants wanted apps, not help desks.

In a country built on speed, traditional real estate simply couldn’t keep up.

So the UAE adapted. Fast.

Developers began using data platforms to price properties dynamically, not annually. AI stepped in to forecast demand before projects even broke ground.

Smart sensors moved into buildings, tracking energy use, maintenance needs, and occupancy in real time.

Buildings were no longer just structures.

They became data engines.

On the operations side, smart buildings changed the economics.

Automated systems improved tenant comfort and reduced inefficiencies. Sustainability stopped being a casual statement and became measurable, trackable, and reportable.

Government backing accelerated everything. Digital systems, transparency, and green development became priorities across the region.

Today, PropTech in the UAE isn’t about replacing real estate.

It’s about upgrading it.

What’s rising in the UAE isn’t just PropTech.

It’s a new standard, a digital-first way of building, buying, and managing real estate, moving at the speed the UAE is known for.

Government & Regulations – The Real Tech Enabler Behind UAE Real Estate

One of the biggest reasons PropTech scaled so quickly in the UAE isn’t startups alone.

It’s the government.

Instead of resisting change, UAE authorities actively redesigned real estate systems to work digitally, securely, and at scale.

Digital-First Land & Property Systems

Entities like the Dubai Land Department (DLD) moved core real estate services online.

Title deeds, registrations, ownership verification, and transaction records became digital cutting paperwork, reducing errors, and speeding up transfers.

This shift didn’t just improve efficiency.

It built trust.

Blockchain-Based Title Deeds & Records

The UAE was among the first to introduce blockchain-backed property records. Ownership data is now immutable, transparent, and tamper-proof, which reduces fraud and disputes.

What does it mean for buyers and investors?

For buyers and investors, especially international ones, this added a layer of confidence that traditional systems struggled to provide.

Smart Contracts & E-Registration

Smart contracts replaced manual approvals with automated, rule-based execution. Property transfers, leasing agreements, and escrow processes became more predictable.

Instead of weeks, transactions could be completed in days, sometimes even hours.

RERA & Regulatory Standardization

Regulatory bodies like RERA played a key role in setting digital standards.

From broker licensing to project approvals and off-plan regulations, compliance became more structured and transparent through tech-enabled platforms.

This reduced ambiguity for developers, agents, and buyers alike.

Paperless Transactions as Policy

Digital transformation wasn’t optional, it was policy.

Paperless strategies aligned with the UAE’s broader smart city vision, making digital real estate transactions the norm rather than the exception.

Green Development & Regulatory Push

Regulations also encouraged sustainable and green development.

Smart monitoring systems now support energy efficiency reporting, environmental compliance, and green building certifications turning sustainability into a measurable outcome.

It doesn’t only stay a promise.

Why Does It Matter?

In many markets, PropTech fights regulation. In the UAE, regulation powered PropTech.

By aligning policy, technology, and real estate, the government didn’t just modernize transactions, it created an ecosystem where digital real estate could scale safely, securely, and globally.

This foundation is what allowed PropTech in the UAE to move fast without breaking trust.

How UAE is Moving Beyond Gut Based Decisions?

For decades, property pricing in the UAE relied heavily on comparisons, experience, and instinct.

Location mattered. Timing mattered. Market sentiment mattered.

But the data behind those decisions was often incomplete or outdated.

That changed with PropTech.

From Static Prices to Dynamic Valuation

Modern real estate platforms now use Automated Valuation Models (AVMs) to assess property value in real time.

Instead of annual price reviews, values adjust dynamically based on live market data.

Factors like transaction history, demand trends, property type, and neighborhood performance are analyzed continuously, not periodically.

Micro-Market Intelligence

Pricing is no longer decided at a city or community level alone.

Data now goes deeper.

Footfall patterns, nearby infrastructure, lifestyle amenities, rental demand, and even mobility data influence how properties are valued.

Two units in the same building can be priced differently based on data-backed performance indicators.

AI-Led Demand Forecasting

Artificial intelligence plays a key role in predicting demand before it becomes visible in the market. Developers can identify high-potential locations early.

Investors can assess risk more accurately.

Buyers gain clearer insight into future value rather than just current pricing. This reduces speculation and improves decision quality across the board.

Impact on Buyers, Sellers, and Investors

For buyers, pricing becomes more transparent.

For sellers, listings align closer to real market demand.

For investors, returns are modeled using predictive data rather than assumptions.

In a fast-moving market like the UAE, this shift from intuition to intelligence has become a competitive advantage.

| Area of Transformation | Before PropTech (%) | After PropTech (%) | Impact Description | |

| Transaction Speed | 35 | 80 | Faster digital registrations and smart contracts | |

| Pricing Accuracy | 45 | 85 | AI-driven valuation models | |

| Tenant Satisfaction | 50 | 78 | Apps, automation, smart services | |

| Operational Cost Efficiency | 40 | 70 | Smart maintenance & IoT systems | |

| Sustainability Tracking | 30 | 75 | Energy monitoring & ESG reporting | |

| Investor Transparency | 42 | 82 | Blockchain records & digital access | |

Transaction Speed — From Weeks to Days

Not too long ago, property transactions in the UAE could easily stretch to 2–4 weeks. Most of that time wasn’t spent negotiating, it was lost in manual verification, paperwork, and approvals. Digital land registries, e-registration, and smart contracts have quietly removed those bottlenecks. Today, transaction timelines are 70–80% faster, and ownership transfers are often completed within 24–72 hours. Speed has gone from being an operational benefit to a genuine competitive edge.

Pricing Accuracy — Powered by Real-Time Data

Property pricing used to rely heavily on broker instinct and surface-level comparisons. As a result, accuracy hovered around 40–50% at best. That’s changed with AI-led valuation models and live market data. Prices are now adjusted continuously based on demand, supply, and hyper-local signals, pushing accuracy levels to 80–85%. Automated Valuation Models don’t just price smarter, they reduce overpricing, shorten negotiation cycles, and increase deal closures.

Tenant Satisfaction — Experience Becomes the Differentiator

In manually managed buildings, tenant satisfaction typically struggled to cross the 50% mark. Slow maintenance, fragmented communication, and delayed responses were part of the norm. Tech-enabled properties operate differently. Tenant apps, smart service systems, and automation have pushed satisfaction levels to 75–80%. More importantly, retention rates are 20–25% higher, proving that experience now directly influences rental stability and long-term returns.

Operational Cost Efficiency — Smart Buildings, Smarter Economics

Before PropTech adoption, operational efficiency in property management stayed below 45%, largely due to reactive maintenance and inefficient workflows. IoT sensors and predictive maintenance have reshaped that model. Efficiency levels now sit around 65–70%, while maintenance costs have dropped by up to 30%. It’s a shift from fixing problems late to preventing them early, and the economics speak for themselves.

Sustainability Tracking — From Claims to Measurable Impact

Sustainability used to be more about positioning than proof. Only 25–30% of buildings could properly track energy use or environmental performance. With smart energy systems and ESG reporting tools, that figure has climbed to 70–75%. In the UAE, green-certified buildings are now seeing higher occupancy and stronger resale value, reinforcing that sustainability isn’t just ethical, it’s commercially smart.

Investor Transparency — Building Trust Through Technology

Investor transparency, especially in off-plan and cross-border transactions, historically hovered around 40%. Limited visibility often meant higher perceived risk. Blockchain-backed records, real-time dashboards, and digital reporting have changed that equation, pushing transparency beyond 80%. For international investors, this level of clarity has become one of the strongest signals of trust, and a key reason the UAE continues to attract global capital.

Future Outlook – What UAE Real Estate Looks Like in 5 to 10 Years?

Digital-First Transactions

The UAE real estate market is moving fully into a digital-first era. Over the next decade, buying, selling, renting, and managing properties will look very different.

Most property transactions in major cities like Dubai and Abu Dhabi will be paperless. Smart contracts, blockchain-backed title deeds, and e-registration platforms will make deals faster, more transparent, and accessible from anywhere. By 2030, nearly 90 percent of transactions could be handled completely online.

AI-Powered Investment Decisions

Artificial intelligence will guide investment and development decisions. Predictive models will forecast demand, rental yields, and market trends with 80 to 90 percent accuracy. This will help developers and investors make smarter decisions with less risk.

Smart and Connected Buildings

Buildings will become fully connected ecosystems. Sensors, IoT devices, and centralized management systems will monitor energy, maintenance, security, and tenant services in real time. Operational efficiency is expected to improve by 30 to 40 percent compared to current standards.

Sustainability as the Standard

Sustainability will no longer be optional. Most new developments will meet ESG standards and track energy, water, and carbon metrics in real time. Green buildings will influence rental demand, resale value, and investor interest.

Fractional Ownership and Global Investment

Fractional ownership and global investment will grow. Digital platforms will allow international investors to buy parts of properties remotely. Cross-border investment could grow two to three times over the next decade as trust in digital platforms increases.

Enhanced Tenant Experience

Tenant experience will become a priority. Mobile apps, automation, and personalized services will make daily life smoother. Rent payments, maintenance requests, and booking amenities will be simple and fast. Tenant satisfaction and retention rates could rise by 20 to 25 percent.

PropTech is not just part of the future. It is the future.

Branex is a forward-thinking digital marketing and website design and development company providing excellence within the digital realm.

The future of UAE real estate is digital, if you want to move forward with website and app development, look no further than Branex, your one stop shop for digital execution and more.

+971 4 2417179

+971 4 2417179 +971 52 181 0546

+971 52 181 0546 info@branex.ae

info@branex.ae